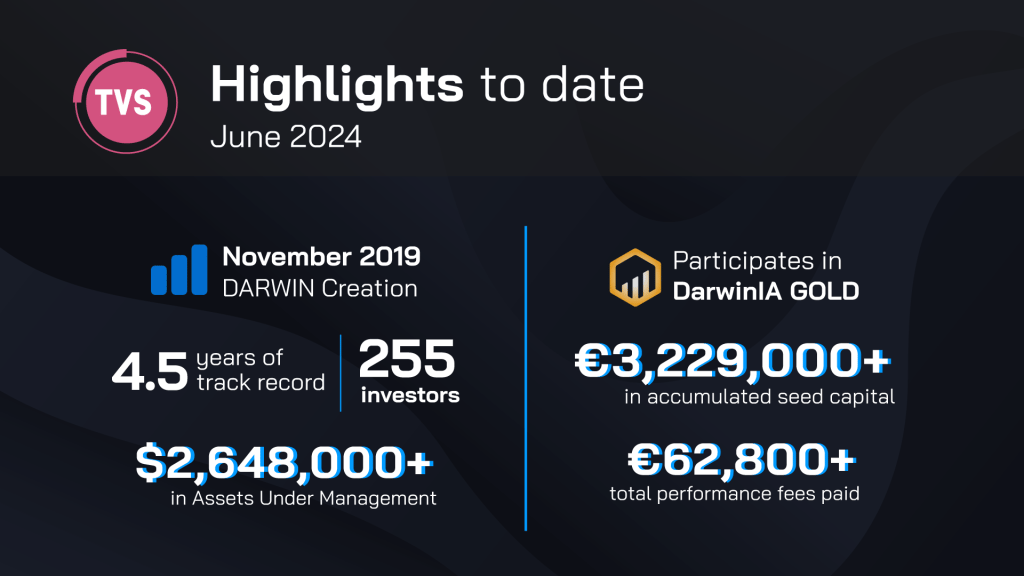

Laxmipati Pandey is a Mechanical Engineer by profession and the trader behind the DARWIN TVS, which currently holds well over 2 million euros in Assets under Management from more than 250 investors in Darwinex.

Despite having no prior knowledge in trading or investing, his career took a significant turn in 2008 when a colleague introduced him to the world of trading. Initially, it was a side interest, but by 2016, with a lot of effort, Laxmipati had transformed into a profitable systematic trader.

In 2017, he fully embraced automated trading, utilizing self-developed Expert Advisors (EAs) and Fully Mechanical Trading Systems. In our interview with him, Laxmipati admitted that it has been “a steep learning curve since 2015” but today, his strategies are grounded in mathematical calculations, simple rules, and indicators.

Like many traders, Laxmipati’s early experiences were marked by challenges and setbacks. When asked about blowing up his first trading account, he laughed and said “not just once, but multiple times over the initial 7 years”. Fortunately, his well-paying full-time job as an engineer allowed him to persist through these financial setbacks.

For Laxmipati, these initial failures were crucial learning experiences that taught him that trading is a “serious business and not a quick way to make money”. Over time, he realized that mechanical trading suited his psychological makeup because it enabled him to manage his emotions effectively.

Today, his DARWIN TVS is managed by multiple EAs and runs automated, using the money management formula of Kelly Criterion. His trading approach is idea-driven rather than data-mined, developing his EA on concepts such as trend, volatility, and divergence. He rigorously backtests these ideas-driven EAs across multi-asset and multi-timeframe data to identify the best-performing instruments for each idea-driven EA and common settings that ensure the best positive expectancy.

Attracting over 2 million euros on Darwinex is a testament to Laxmipati’s expertise and the trust he has earned from investors. He sees this accomplishment as a “significant responsibility” and a “privilege” that motivates him to adhere to strict risk management protocols to safeguard the investments entrusted to him. Both short and long term, he aims to achieve even more consistent profitability and continually refining his trading skills.

To ensure continuous improvement, Laxmipati employs a disciplined approach to his trading practices. He consistently considers a positive expectancy system, journaling and performance analysis, risk management, and continuously seeking ideas to improve existing strategies. Additionally, he focuses on backtesting and trading only simple strategies while maintaining the psychological discipline to adhere to his strategy during drawdowns.

Laxmipati’s journey from a Mechanical Engineer to a successful trader underscores the importance of perseverance, continuous learning, self-awareness, and emotional management. When asked for his advice for traders who are just starting out, he offered five final tips:

- Focus on trading skills development.

- Build a track record.

- Prioritize transparency and integrity.

- Emphasize risk management.

- Stay committed to your goals.